WASHINGTON ― A bipartisan duo of House lawmakers has banded together to improve the vetting of financial advisers for service members. The move comes after an Army counselor with undisclosed conflicts of interest with outside brokerage firms allegedly swindled two dozen Gold Star families.

The House in July passed legislation from Reps. Mikie Sherrill, D-N.J., and Don Bacon, R-Neb., that would require the Defense Department verify its roughly 400 military financial advisers are without conflicts of interest by having them submit annual financial disclosures.

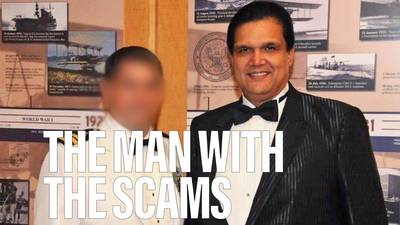

Sherrill and Bacon introduced the legislation as an amendment to the fiscal 2024 defense policy bill after a report by The Washington Post detailed how an Army financial counselor, Caz Craffy, allegedly mismanaged a cumulative $750,000 in four families’ life insurance funds by placing the money in the brokerage accounts of firms where he simultaneously worked.

Several Army families had alleged one counselor lost a cumulative $750,000 in life insurance investments while failing to disclose his connections to outside brokerage firms.

“We have an obligation to support our Gold Star Families who have lost loved ones that made the ultimate sacrifice for our country,” Sherrill said in a statement. “Rather than honor that obligation, Caz Craffy saw it as an opportunity to enrich himself and steal from these vulnerable families in mourning.”

Sherrill said her legislation would “close the legal gaps Mr. Craffy slipped through to hide his schemes” and “stop people from preying on families in the future.”

The Washington Post reported in February that the Army’s Criminal Investigation Division has contacted the four families, all of whom reside in New York and New Jersey. Craffy stopped working for the Army in January. He simultaneously worked for the New Jersey-based Monmouth Capital Management, which he left in November 2023.

The Justice Department in July indicted Craffy for allegedly defrauding 24 Gold Star families in total.

“Stealing from Gold Star families whose loved ones made the ultimate sacrifice in service to our nation is a shameful crime,” Attorney General Merrick Garland said in a statement. “As alleged in the indictment, the defendant in this case used his position as an Army financial counselor to defraud Gold Star families, steal their money, and enrich himself.”

The armed services employ financial counselors to educate families on their life insurance benefits, but those individuals do not usually invest the money on behalf of their clients.

“Our military families must be able to know that financial counselors employed by the Department of Defense are properly vetted and have the servicemember’s best interests in mind,” Bacon said in a statement. “I partnered with Rep. Sherrill to close this loophole and prevent harmful predatory practices that would negatively impact our servicemembers.”

The Sherrill-Bacon amendment, which aims to prevent future conflicts of interest, passed the House as part of the defense policy bill in July. That bill passed in an unusually narrow 219-210 vote, largely along party lines due to unrelated partisan policy provisions on issues like abortion, transgender troops and diversity initiatives.

The Senate version of the defense policy bill, which passed 86-11 in July, does not contain an analogous amendment to strengthen financial counselor vetting. However, Sherrill’s office said her team is working with colleagues in the Senate to introduce identical legislation in the upper chamber, which would increase the odds of the provision surviving negotiations on a final defense bill.

Bryant Harris is the Congress reporter for Defense News. He has covered U.S. foreign policy, national security, international affairs and politics in Washington since 2014. He has also written for Foreign Policy, Al-Monitor, Al Jazeera English and IPS News.