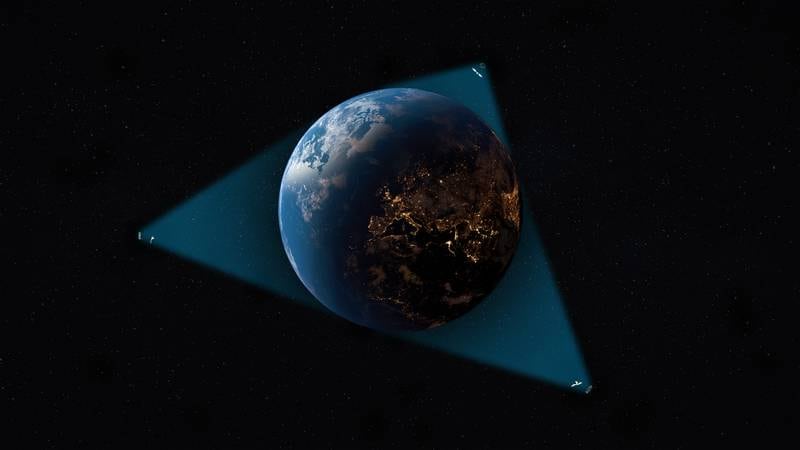

WASHINGTON — The Space Force has finalized a plan for harnessing commercial satellite capabilities in times of crisis through a Commercial Augmentation Space Reserve.

That strategy, approved in this month by Air Force Secretary Frank Kendall, outlines a framework for how the Space Force will scale up its use of commercial capabilities including satellite imagery and communications during a conflict to augment military systems.

“It’s an example of doing the planning and the expectation management before you actually need the capability,” Chief of Space Operations Gen. Chance Saltzman said at an Oct. 18 event hosted by the Center for a New American Security. “So, pre-working the contract vehicles, pre-working . . . how would we get access to this rapidly if we needed to, so that when the crisis occurs, we don’t then start the contracting action, start the discussion.”

The service’s acquisition arm, Space Systems Command, announced last year it was making plans to create a Commercial Augmentation Space Reserve, or CASR. The team met with industry in February and created a task force soon after to work through legal, policy, contracting and programmatic concerns.

The resulting strategy, according to the head of the Commercial Space Office Col. Richard Kniseley, factors in those concerns as well as feedback from more than 60 companies. That partnership, he said during an Oct. 18 Space Industry Days conference, is key to ensuring the government and industry both understand the requirements and risks associated with leaning more heavily on commercial systems during conflict.

RELATED

“The whole premise of CASR is that we know in a threat that the capacity requirements during crisis or conflict are expected to exceed peacetime, steady-state requirements,” he said. “We needed the ability to be able to be integrated, operated, wargamed and potentially prioritized depending on how expensive the battle is.”

The CASR strategy comes amid growing concern from some Pentagon officials and members of Congress about the role of commercial industry, and particularly Elon Musk’s SpaceX, in military space operations. Musk, who provided terminals to Ukraine to access his company’s Starlink communication satellites, has said he opted not to activate the capability in certain regions to prevent Ukraine from targeting key Russian assets due to escalation concerns.

The Space Force recently awarded SpaceX a $70 million contract to provide Starlink services and is heavily reliant on the company to launch military satellites.

Asked whether he’s concerned companies like SpaceX could make decisions that impede U.S. military operations, Saltzman emphasized that any Space Force contracts with commercial firms have detailed terms and requirements that are not subject to the whim of a CEO.

“We write contracts with SpaceX, not Elon Musk,” he said. “We do expectation management, we put those details in the contract and then we expect that they’ll follow through. And I have no reason to believe that they won’t.”

Companies who sign on to CASR will also be subject to contractual terms, and Kniseley explained that the strategy lays out a spectrum of services firms can provide to support scenarios ranging from day-to-day operations to a national war.

Under level one operations, firms would provide a minimum commitment of peacetime capabilities to the Defense Department. Level Two, which includes regional conflicts or a major crisis, would require a higher level of commercial services. In a level three wartime scenario, companies would be obligated to prioritize government needs over their other customers.

Kniseley noted that the Space Force is initially restricting CASR involvement to U.S.-owned companies or those firms owned by another country that have implemented measures to protect against the unauthorized release of classified information — a process known as Foreign Ownership, Control or Influence mitigations. He said the service is considering further options for integrating international firms.

With the strategy approved, the Commercial Space Office is now working to finalize its concept of operations for CASR and craft a funding plan for the next few years. Kniseley said there may be some flexibility within the service’s fiscal 2024 and 2025 budgets to provide initial funding for the reserve, but the service plans to formalize its CASR spending plan in its FY26 budget request.

Commercial integration

The CASR strategy is just one piece of the Space Force’s approach to engaging with commercial industry, both in peacetime and wartime.

The service has also been crafting a broader strategy meant to answer fundamental questions about which capabilities it wants to buy from industry, which it wants to own and how it will integrate commercial services and systems into its architecture and day-to-day operations.

A team led by Lt. Gen. Philip Garrant, deputy chief of space operations for strategy and programs, submitted an initial strategy for Saltzman’s approval earlier this fall, but the Space Force chief requested more detail.

“I didn’t think it provided the necessary specificity that would really help industry give us what we needed,” he said this week, adding that he’s hopeful the plan will be completed by the end of the year.

Saltzman said he wants the strategy to include more detail on things like software procurement mechanisms. He also wants it to address which capabilities and functions the Space Force wants to perform and where it prefers to buy commercial services.

“I just felt like it was important that we answered these questions first, so that when we say what we need to industry, we can say it with enough specificity that we can really get what we’re looking for,” he said. “I’m pushing them hard, because I know there’s a hunger for this.”

Courtney Albon is C4ISRNET’s space and emerging technology reporter. She has covered the U.S. military since 2012, with a focus on the Air Force and Space Force. She has reported on some of the Defense Department’s most significant acquisition, budget and policy challenges.